Managing multiple retail locations with varying tax rules can be overwhelming. Keeping up with constantly changing sales tax laws adds to the complexity.

Introducing Avalara—a game-changer for retail stores navigating diverse states and localities. Retail Control Systems (RCS) has teamed up with Avalara to enhance tax solutions by integrating Avalara’s advanced tools with NCR Counterpoint, a leading retail point-of-sale (POS) system. This partnership offers accurate, real-time tax calculations, simplifying retail business tax management.

Comprehensive Tax Reporting Capabilities

Avalara’s Avatax integration provides more than accurate tax calculations; it significantly improves business operations with its robust tax reporting capabilities. Here’s how Avalara enhances tax management:

Avalara’s Avatax integration provides more than accurate tax calculations; it significantly improves business operations with its robust tax reporting capabilities. Here’s how Avalara enhances tax management:

- Real-Time Tax Reporting: Get immediate access to tax data, allowing businesses to monitor and review tax information as transactions occur. This real-time visibility helps quickly identify and address any issues.

- Detailed Sales Tax Reports: Avalara generates detailed reports breaking down sales tax by jurisdiction, product type, and more. These reports simplify understanding tax liabilities, preparing for audits, and providing insights into tax data across multiple locations.

- Automated Filing and Remittance: Avalara automates the filing of sales tax returns and remittance to tax authorities, reducing administrative burdens and ensuring accurate and timely submissions.

- Exemption Certificate Management: Manage exemption certificates effortlessly with Avalara’s automation. It handles certificates’ collection, storage, and validation, ensuring compliance and easing record-keeping.

- Customizable Reports: Create tailored reports focusing on specific periods, sales channels, or product categories, offering valuable insights for better decision-making.

- Integration with Accounting Systems: Avalara integrates seamlessly with accounting systems like QuickBooks POS, ensuring smooth data flow between your POS and accounting software and improving accuracy.

- Audit Trail and Documentation: Avalara maintains a comprehensive audit trail that documents all tax-related transactions and adjustments. This feature is crucial for smooth audit processes and demonstrates compliance.

- Regulatory Compliance: Stay updated with the latest tax laws and regulations with Avalara, ensuring compliance and minimizing mistakes.

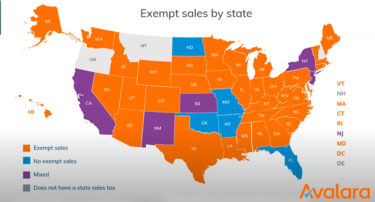

The advantages are substantial. Businesses utilizing automated tax solutions like Avalara experience significant reductions in audit risks and tax-related errors. In a recent survey, of the 40% of respondents who revealed that their business has been audited within the past three years, 63% said consumer use tax was a substantial part of the audit process. Avalara’s solutions cover all aspects of tax compliance, including sales tax calculation, exemption management, and tax filing services.

Why is this integration with NCR Counterpoint so beneficial?

It guarantees that retailers charge the correct tax on every sale, no matter how complex local tax laws may be. This accuracy is crucial for businesses with multiple locations or those selling online across various states.

It guarantees that retailers charge the correct tax on every sale, no matter how complex local tax laws may be. This accuracy is crucial for businesses with multiple locations or those selling online across various states.

Charging the right amount of tax is important for compliance and customer satisfaction. Overcharging or undercharging can lead to customer issues and legal complications.

RCS ensures that your NCR Counterpoint system integrates seamlessly with Avalara for precise sales tax calculations. The RCS API facilitates easy integration, making it an excellent choice for retail POS software.

In summary, integrating Avalara with RCS’s retail POS system is a smart decision for retailers looking to simplify tax compliance and reporting. By automating tax calculations, reporting, and filing, retailers can focus on their core operations, knowing their sales tax management is in capable hands.

Ready to streamline your sales tax compliance? Let Avalara handle the complexities. RCS will help you manage your business effectively. Contact us today for tax compliance software integrations with your point of sale.